Originally Published: on Nov. 14, 2020 | The Wall Street Journal | By Glenn Ruffenach

My wife and I retired last year. Since March, we have been walking almost daily as a way to fight cabin fever. As a result, we seem to be in better physical shape now than when the pandemic began. What are you seeing among retirees? Any ideas about expanding fitness routines at home?

Add some strength training.

When it comes to fitness, most people focus on aerobic or “cardio” workouts. Such activities—bicycling, swimming, jogging—clearly are important. But equally important, especially for the 60-plus crowd, is some form of strength or “resistance” training.

As we age, “loss of muscle strength and power leads to declining activity, increased frailty and functional dependence,” according to the American College of Sports Medicine. “On the positive side, resistance training has proved to be a safe, economical and beneficial addition to the older adult’s fitness regimen.”

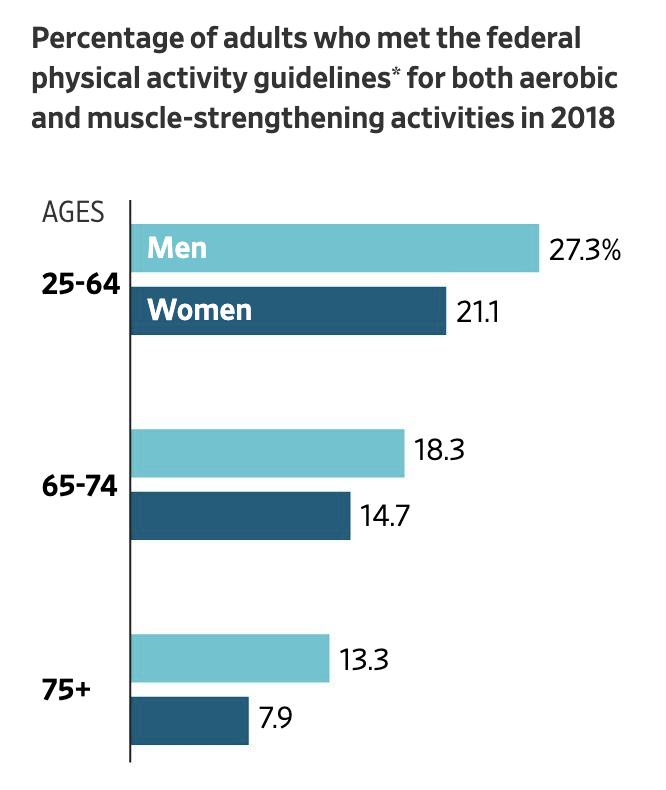

How much training? The Centers for Disease Control and Prevention recommends that adults age 65 and older participate in activities at least two days a week that “strengthen muscles,” along with a minimum of 150 minutes a week of “moderate intensity activity, such as brisk walking.”

Source: National Center for Health Statistics, “2018 National Health Interview Survey”

Strength training, at the outset, doesn’t mean “pumping iron” or buying a pricey home gym. Sure, you might end up bench-pressing your body weight (a difficult but not impossible goal). To start, though, lifting something as simple as bottled water or soup cans, according to the National Institute on Aging, can give you the exercise you need.

To learn more about strength and resistance training, begin with a CDC publication, “Growing Stronger: Strength Training for Older Adults,” a terrific introduction to the topic. Also visit the Exercise and Physical Activity page on the National Institute on Aging’s website. The article “4 Types of Exercise” provides a good overview of the subject, and “Exercise and Physical Activity Tracking Tools” can help you record your progress.

A good book about strength training for older adults is “Weights for 50+” by Karl Knopf. And a valuable resource about fitness in general for older adults is “Exercise & Physical Activity: Your Everyday Guide” from the National Institute on Aging.

I recently lost my wife at age 54. I’m wondering if I have any claim to her over-38-years of paying into Social Security. We were married 27 years. I have one child who is 23.

I’m sorry for your loss. You can claim Social Security benefits as a survivor. In fact, you have some flexibility here.

To start, as is the case with most decisions involving Social Security, the longer you wait to file for benefits, the larger the payout. If you first claim a survivor’s benefit at your “full-retirement age” (the age when a person first qualifies for unreduced benefits), you would be eligible for 100% of what would have been your wife’s benefit at her full-retirement age. Or, you can claim a reduced survivor’s benefit as early as age 60.

What’s more, you have the ability to switch benefits. For instance, you could claim a reduced survivor’s benefit at 60 and then switch to your benefit, the one based on your earnings history, as early as age 62. The Social Security Administration does a good job of outlining all of these options on its website.

Finally, you mentioned your child. In some instances, children are eligible for Social Security benefits. For most, however, those payouts end at age 18.

My husband and I are thinking about changing our prescription-drug coverage during Medicare’s open-enrollment period. Do the two of us have to pick the same insurance plan, or can we choose different plans?

You can choose different plans.

Medicare’s open-enrollment period runs each year from Oct. 15 through Dec. 7. During this time, beneficiaries can switch fairly easily, and without penalty, from one health plan to another—say, from original Medicare to a Medicare Advantage plan (and vice versa), or from one prescription-drug plan to a competing prescription-drug plan.

During your working years, you and your spouse, in all likelihood, were covered by a single insurance plan. But that isn’t the case with Medicare; you and your husband can, and should, pick a plan—including a prescription-drug plan (Medicare Part D)—that best meets your particular needs. For instance, if you require medication for heart disease, you might benefit from using a Part D plan (one, say, with lower premiums for your specific drug) that differs from your husband’s plan.

If you need help selecting a Part D plan, start with the Medicare Plan Finder. Also try “SHIP,” your State Health Insurance Assistance Program. SHIPs operate in all 50 states and offer free counseling and assistance to Medicare-eligible individuals, their families and caregivers.

And speaking of Medicare…here’s a new book that can ease your entry into the program: “Medicare Entry Guide” by Neil Brown, a road map for enrolling in, and making sense of, an all-too-complicated program.

Mr. Brown, a longtime Medicare insurance consultant, actually starts his book on the cover. Based on your age and situation (example: “I’m 64 and I might postpone Medicare”), he directs you to the appropriate page inside and begins walking you through the Medicare maze. A smart approach and well worth your time.

Mr. Ruffenach is a former reporter and editor for The Wall Street Journal. His column examines financial issues for those thinking about, planning and living their retirement.